What Is A Residential Mortgage?

A residential mortgage is a loan provided by a financial institution or lender to help individuals purchase a home or residential property. The property being purchased serves as collateral for the loan, meaning that if the borrower fails to repay the loan, the lender has the right to take possession of the property through a legal process known as foreclosure.

Key Components Of A Residential Mortgage

- Principal: This is the initial amount of money borrowed to purchase the home. It does not include interest or any additional fees.|

- Interest Rate: The cost of borrowing the principal amount, expressed as a percentage. It can be fixed (stays the same throughout the loan term) or variable (can change at specified times).

- Term: The length of time over which the loan must be repaid. Common mortgage terms are 15, 20, and 30 years.

- Down Payment: An upfront payment made by the buyer. It is usually a percentage of the property’s purchase price. Larger down payments can reduce the amount borrowed and may result in better loan terms.

- Amortization: The process of gradually paying off the loan through regular monthly payments. These payments cover both the principal and the interest.

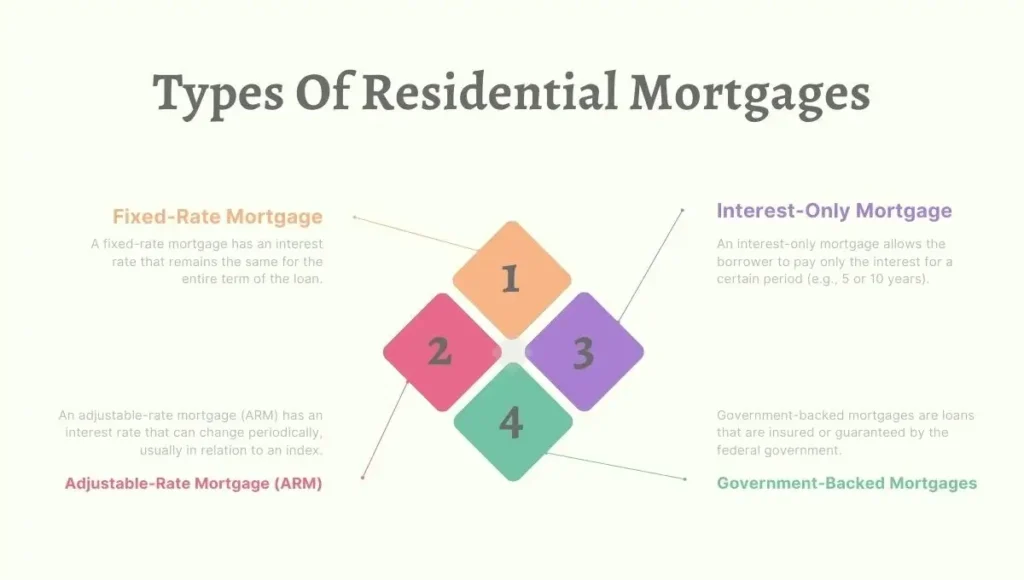

Types Of Residential Mortgages

Fixed-Rate Mortgage

A fixed-rate mortgage has an interest rate that remains the same for the entire term of the loan. This means your monthly payments will be consistent and predictable, making it easier to budget. It is ideal for borrowers who plan to stay in their home for a long time and prefer stability.

Adjustable-Rate Mortgage (ARM)

An adjustable-rate mortgage (ARM) has an interest rate that can change periodically, usually in relation to an index. The rate typically starts lower than that of a fixed-rate mortgage for an initial period (e.g., 5 years) and then adjusts annually. This type of mortgage may be suitable for borrowers who expect their income to increase or who plan to sell or refinance before the rate adjusts.

Interest-Only Mortgage

An interest-only mortgage allows the borrower to pay only the interest for a certain period (e.g., 5 or 10 years). After this period, the borrower starts paying both principal and interest. These loans can lower monthly payments initially but can lead to higher payments later. They are often used by those who expect to sell or refinance before the interest-only period ends.

Government-Backed Mortgages

Government-backed mortgages are loans that are insured or guaranteed by the federal government. These include:

- FHA Loans: Insured by the Federal Housing Administration, these loans are designed for low-to-moderate-income borrowers and require a lower down payment.

- VA Loans: Guaranteed by the Department of Veterans Affairs, these loans are available to eligible veterans, active-duty service members, and some military spouses. They often require no down payment.

- USDA Loans: Guaranteed by the U.S. Department of Agriculture, these loans are for rural and suburban homebuyers and may require no down payment.

Each type of government-backed mortgage has specific eligibility requirements and benefits, making homeownership more accessible to different groups of people.

How to Get a Residential Mortgage

Getting a residential mortgage involves several steps. Here’s a simplified guide to help you through the process:

Check Your Credit Score

Your credit score plays a significant role in determining your eligibility for a mortgage and the interest rate you’ll receive. Check your credit report for errors and work on improving your score if necessary. A higher credit score can lead to better loan terms.

Determine Your Budget

Calculate how much you can afford to spend on a home. Consider your monthly income, existing debts, and how much you can pay as a down payment. Use online mortgage calculators to estimate your monthly payments and see what fits your budget.

Get Pre-Approved

Before you start house hunting, get pre-approved for a mortgage. This involves a lender reviewing your financial situation and providing a conditional commitment for a loan amount. Pre-approval shows sellers that you are a serious buyer and can afford the home.

Choose a Lender

Shop around for the best mortgage rates and terms. Compare offers from different lenders, including banks, credit unions, and online lenders. Look at interest rates, fees, and customer reviews to find the best fit for you.

Complete the Application

Once you choose a lender, complete the mortgage application. You’ll need to provide various documents, such as proof of income (pay stubs, tax returns), employment verification, bank statements, and information about your debts and assets.

Loan Processing

After you submit your application, the lender will begin processing it. This includes verifying your financial information, ordering a home appraisal to determine the property’s value, and conducting a title search to ensure there are no issues with ownership.

Underwriting

The underwriting process involves a thorough evaluation of your financial situation by the lender. The underwriter assesses your creditworthiness, income stability, and the property’s value to decide whether to approve the loan.

Closing

If your loan is approved, you’ll move to the closing stage. During closing, you’ll sign final loan documents and pay closing costs, which can include fees for processing the loan, appraisal, and title insurance. After signing the paperwork and paying the required costs, the lender will disburse the loan amount, and you will officially own your new home.

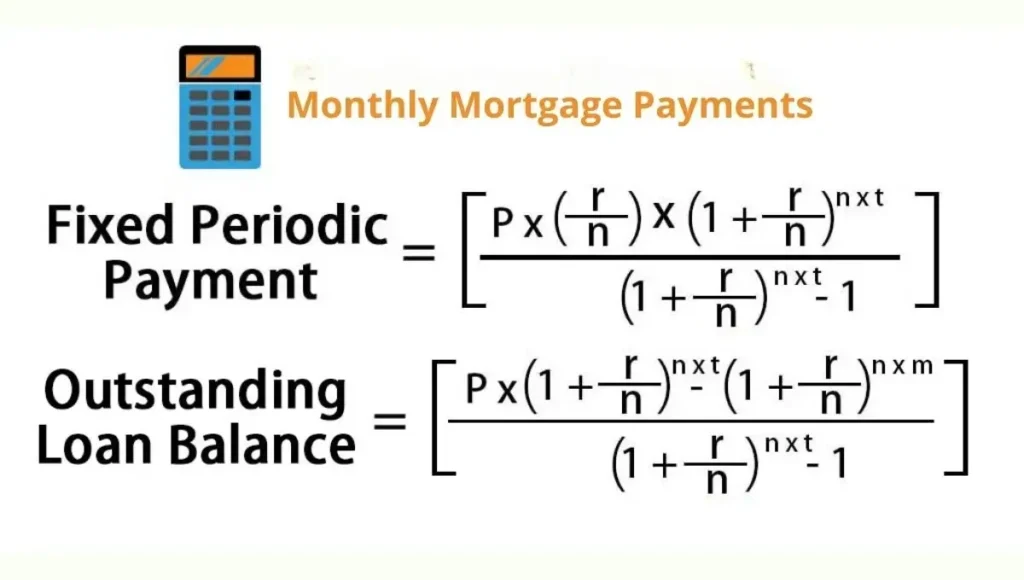

Monthly Mortgage Payments

When you take out a residential mortgage, your monthly mortgage payment typically includes several components. Understanding these components can help you manage your finances effectively.

Principal and Interest

- Principal: This is the amount of money you originally borrowed to purchase the home. Each monthly payment reduces the principal balance slightly.

- Interest: This is the cost of borrowing money from the lender, expressed as an annual percentage rate (APR). A portion of your monthly payment goes towards paying interest on the remaining loan balance.

Property Taxes

Local governments charge property taxes based on the assessed value of your home. These taxes fund public services like schools, roads, and emergency services. Lenders often collect property taxes as part of your monthly mortgage payment and hold the funds in an escrow account until the taxes are due.

Homeowners Insurance

Homeowners insurance protects your property against risks such as fire, theft, and natural disasters. It also provides liability coverage in case someone is injured on your property. Lenders typically require you to have insurance and may include the premium in your monthly payment, holding the funds in escrow.

Private Mortgage Insurance (PMI)

If your down payment is less than 20% of the home’s purchase price, your lender may require private mortgage insurance (PMI). PMI protects the lender if you default on the loan. The cost of PMI is added to your monthly mortgage payment until you have enough equity in your home (usually 20%) to cancel it.

Example Breakdown of a Monthly Mortgage Payment

Let’s say you have a $200,000 mortgage with a 4% interest rate and a 30-year term. Here’s a simplified breakdown of what your monthly payment might look like:

- Principal and Interest: $955

- Property Taxes: $150 (this amount can vary widely based on local tax rates)

- Homeowners Insurance: $75 (the actual cost depends on the value and location of your home)

- Private Mortgage Insurance (PMI): $100 (if required)

Total Monthly Payment: $1,280.

Escrow Account

An escrow account is a separate account where the lender holds funds collected for property taxes and insurance. Each month, part of your mortgage payment goes into the escrow account. When your property taxes and insurance premiums are due, the lender uses the funds in the escrow account to pay them on your behalf. This ensures that these important expenses are paid on time.

Pros and Cons of Having a Residential Mortgage

A residential mortgage is a significant financial commitment with both advantages and disadvantages. Understanding these can help you make an informed decision about homeownership.

| Pros | Cons |

|---|---|

| Homeownership | Long-Term Financial Commitment |

| Building Equity | Monthly Payments and Interest Costs |

| Tax Benefits | Risk of Foreclosure |

| Predictable Payments | Market Fluctuations |

| Potential for Home Appreciation | Ongoing Costs |

| Opportunity for Personalization | Private Mortgage Insurance (PMI) |

Pros Of Having A Residential Mortgage

Homeownership

- Advantage: A mortgage allows you to buy a home and build equity over time. Unlike renting, where monthly payments go to a landlord, mortgage payments help you gradually own a valuable asset.

- Why It Matters: Homeownership can provide stability and a sense of accomplishment. Over time, the value of your home may increase, contributing to your net worth.

Building Equity

- Advantage: Each mortgage payment reduces the loan principal and builds equity in your home. Equity is the portion of the home’s value that you actually own.

- Why It Matters: As you pay down your mortgage, you build equity, which can be used for future financial needs, such as home improvements or a down payment on a new home.

Tax Benefits

- Advantage: Mortgage interest payments and property taxes are often tax-deductible. This can reduce your taxable income and lower your overall tax bill.

- Why It Matters: These deductions can lead to significant savings on your annual taxes, making homeownership more affordable.

Predictable Payments with Fixed-Rate Mortgages

- Advantage: With a fixed-rate mortgage, your monthly payment remains the same for the entire loan term. This consistency helps with budgeting and financial planning.

- Why It Matters: Stable payments make it easier to manage your finances and avoid surprises in your monthly budget.

Potential for Home Appreciation

- Advantage: Over time, the value of your home may increase due to market trends and improvements you make.

- Why It Matters: A rise in home value can increase your home’s equity and provide a return on your investment if you decide to sell.

Opportunity for Personalization

- Advantage: As a homeowner, you have the freedom to make changes and improvements to your property.

- Why It Matters: You can customize your living space to fit your preferences and needs, creating a more enjoyable and personal environment.

Cons of Having a Residential Mortgage

Long-Term Financial Commitment

- Disadvantage: A mortgage is a long-term obligation, often lasting 15 to 30 years. This commitment requires consistent monthly payments.

- Why It Matters: It can limit your financial flexibility and impact other areas of your budget and long-term financial goals.

Monthly Payments and Interest Costs

- Disadvantage: Monthly mortgage payments include principal, interest, property taxes, and insurance. Over the life of the loan, you’ll pay a significant amount in interest.

- Why It Matters: The total cost of homeownership includes more than just the purchase price of the home. High interest payments can make the mortgage more expensive over time.

Risk of Foreclosure

- Disadvantage: If you fail to make mortgage payments, the lender can initiate foreclosure proceedings to take possession of your home.

- Why It Matters: Foreclosure can result in the loss of your home and damage to your credit score, which can affect future financial opportunities.

Market Fluctuations

- Disadvantage: The value of your home can rise or fall based on the housing market. A drop in home value can result in negative equity if you owe more on the mortgage than the home is worth.

- Why It Matters: If the market declines, you might struggle to sell your home for a profit or refinance your mortgage.

Ongoing Costs

- Disadvantage: Homeownership comes with ongoing costs beyond the mortgage payment, including maintenance, repairs, and utilities.

- Why It Matters: These additional costs can add up, so it’s important to budget for regular home upkeep and unexpected repairs.

Private Mortgage Insurance (PMI)

- Disadvantage: If your down payment is less than 20%, you may need to pay for PMI, which protects the lender if you default on the loan.

- Why It Matters: PMI is an extra cost that adds to your monthly mortgage payment until you reach 20% equity in your home.

Conclusion

A residential mortgage is a significant financial tool that allows you to purchase a home and build equity over time. It offers benefits such as homeownership, the potential for property appreciation, and various tax advantages. A fixed-rate mortgage has steady monthly payments.

Government-backed loans might offer a smaller down payment for those who qualify. However, a mortgage also comes with challenges. It represents a long-term financial commitment and includes monthly costs such as interest, property taxes, and insurance. Risks like foreclosure and market fluctuations can also impact your financial situation.